The Epstein Files Unsealed

A Comprehensive Timeline of Court Documents, Banking Scandals, and Institutional Accountability (2024-2025)

This article focuses exclusively on publicly released court documents, legal proceedings, and institutional investigations. Being named in court documents does not constitute proof of wrongdoing. Many individuals mentioned have denied allegations or have not been accused of any illegal conduct.

📋 Executive Summary

Between January 2024 and November 2025, thousands of pages of court documents and government files related to Jeffrey Epstein’s criminal enterprise were unsealed through multiple legal proceedings. These releases have shed unprecedented light on how financial institutions, particularly JPMorgan Chase, enabled Epstein’s operations for nearly two decades despite numerous red flags.

The unsealed materials include civil lawsuit depositions, banking records showing over $1 billion in suspicious transactions, flight logs, contact books, and congressional investigations. This article provides a factual timeline and analysis of what these documents reveal about systemic failures in financial oversight and institutional accountability.

By the Numbers

January 2024

September 2025

Total Settlements

📅 Timeline of Document Releases

First Major Unsealing

Nearly 950 pages of court filings from Virginia Giuffre’s 2015 defamation lawsuit against Ghislaine Maxwell were released. Documents included depositions describing recruitment tactics and named numerous associates of Epstein’s social circle.

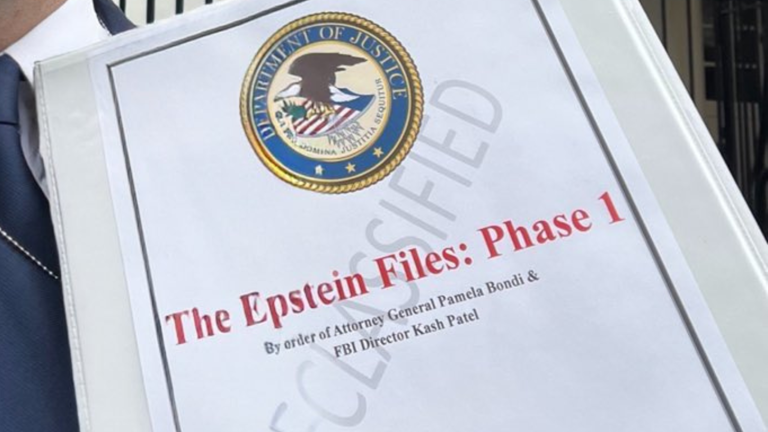

DOJ First Phase Release

Attorney General Pam Bondi released over 100 pages including flight logs, redacted contact books, masseuse lists, and evidence inventories. Many documents had been previously leaked but were now officially declassified.

FBI Investigation Memo

The Justice Department released a memo concluding there was no evidence Epstein kept a “client list” or blackmailed prominent figures. The investigation confirmed Epstein’s death was suicide after reviewing prison cell footage.

Maxwell Interview Transcripts

The DOJ released audio recordings and transcripts of Deputy Attorney General Todd Blanche’s interview with Ghislaine Maxwell, including four redacted transcripts and 16 audio clips.

Congressional Document Dump

The House Oversight Committee released more than 33,000 documents, including thousands of pages of DOJ records. However, many documents were already public according to committee Democrats.

Banking Records Unsealed

JPMorgan Chase suspicious activity reports (SARs) and financial transaction records were released, revealing the bank processed over $1 billion in Epstein-related transactions despite filing red flags dating back to 2002.

🏦 The JPMorgan Banking Scandal: Following the Money

Perhaps the most significant revelations from the unsealed documents concern JPMorgan Chase’s 15-year banking relationship with Epstein from 1998 to 2013. The financial records paint a damning picture of institutional failure and potential complicity.

What the Banking Records Reveal

Key Financial Findings

- Over $1 billion in transactions between October 2003 and July 2019 involving Epstein and numerous related companies

- Suspicious Activity Reports filed as early as 2002, yet Epstein remained a client for 11 more years

- Large cash withdrawals regularly processed even after Epstein’s 2008 guilty plea to sex crimes in Florida

- Connections to Russian banks including Alfa Bank and Sberbank flagged in reports

- High-profile referrals including billionaires and political figures brought to JPMorgan by Epstein

The Settlements: Accountability Without Admission

JPMorgan Chase agreed to pay a total of $365 million in settlements without admitting wrongdoing. Deutsche Bank, which became Epstein’s bank after JPMorgan ended the relationship in 2013, paid an additional $75 million.

“This is a situation in which virtually every institution that is supposed to look out for the weak and the vulnerable failed them.”

Who Knew What, and When?

Internal emails and depositions revealed that senior JPMorgan executives, including those reporting directly to CEO Jamie Dimon, closely supervised the Epstein relationship. A 2010 email directly referenced a meeting between Epstein and Dimon, contradicting earlier claims of ignorance about Epstein’s prominence within the bank.

The unsealed records show JPMorgan continued providing banking services to Epstein even after:

- His 2008 arrest and guilty plea to soliciting prostitution from a minor

- Reaching a controversial non-prosecution agreement with federal prosecutors

- Multiple suspicious activity reports filed by the bank’s own compliance department

- Negative media coverage about alleged sex trafficking activities

📄 What Was Actually in the Unsealed Documents?

January 2024 Release: The Giuffre-Maxwell Case

Documents Included:

- Depositions from survivors describing recruitment methods

- Testimony about how girls were asked to bring friends and paid for referrals

- References to high-profile individuals in Epstein’s social circle

- Legal motions and exhibits from the defamation case

- Previously redacted names now made public

The January 2024 unsealing revealed names including former presidents Bill Clinton and Donald Trump, Britain’s Prince Andrew, billionaire Tom Pritzker, and lawyer Alan Dershowitz. However, most were mentioned in passing, not accused of wrongdoing. Many have previously denied allegations or knowledge of Epstein’s activities.

Important Context

Being mentioned in court documents does not equal proof of illegal conduct. The documents primarily consisted of survivor testimony about Epstein and Maxwell’s operations, with various names appearing in different contexts—from social acquaintances to flight logs to more serious allegations.

2025 Releases: Banking and Congressional Records

The 2025 document releases shifted focus from social connections to financial infrastructure. Unsealed suspicious activity reports showed how JPMorgan processed payments that the bank itself flagged as potentially linked to human trafficking.

Critical Revelations from Banking Records:

- JPMorgan filed its first suspicious activity report on Epstein in 2002, yet maintained the banking relationship for 11 more years

- The bank processed large cash withdrawals and wire transfers even after Epstein’s 2008 conviction

- Internal compliance officers raised concerns that were apparently overridden by relationship managers

- Epstein referred ultra-wealthy clients to JPMorgan, creating financial incentives to maintain the relationship

- Connections to accounts at Russian banks added to the list of red flags

🔍 Congressional Investigations: The Search for Answers

Throughout 2025, multiple Congressional committees have sought additional Epstein-related documents from federal agencies. The House Oversight Committee has been particularly active, though releases have been criticized for including mostly previously public information.

The Treasury File

Senator Ron Wyden’s Finance Committee investigation has focused on Treasury Department records that remain partially sealed. In November 2025, Wyden released an 18-page analysis detailing how JPMorgan executives enabled Epstein’s operations through compliance failures.

According to Wyden’s investigators, the Treasury Department possesses thousands of additional bank records in an “Epstein file” that has not been fully produced despite requests from Congressional oversight committees.

“It was a huge victory passing legislation this week requiring the Department of Justice to release its Epstein file, but I’m extremely concerned Trump and Bondi are faking investigations as a pretext to block any further disclosures.”

⚖️ Legal and Ethical Questions

The “Client List” Controversy

One of the most persistent questions has been whether Epstein maintained a so-called “client list” of individuals who participated in or knew about his crimes. The July 2025 DOJ memo explicitly stated that investigators found no credible evidence of such a list or that Epstein blackmailed prominent individuals.

However, the existence of extensive flight logs, contact books, and financial records has fueled ongoing speculation and political discourse about who knew what about Epstein’s activities.

Institutional Accountability

The unsealed documents raise profound questions about institutional accountability:

- How did major financial institutions continue serving a known sex offender?

- What systemic failures allowed this to continue for years?

- Are settlement payments without admissions of wrongdoing sufficient accountability?

- What reforms are needed to prevent similar failures in the future?

📊 What Documents Remain Sealed?

Despite extensive releases, significant material remains under seal or has not been publicly disclosed:

Still Sealed or Unreleased:

- Treasury Department Records: Thousands of pages of bank records and financial intelligence reports

- Grand Jury Testimony: Transcripts from criminal proceedings that may require court approval to unseal

- Federal Investigation Files: FBI case files totaling over 300 gigabytes of data

- Additional JPMorgan Documents: Internal communications and compliance reviews that remain under protective orders

- Victim Privacy Materials: Documents properly sealed to protect survivor identities

🎯 Key Takeaways

What We’ve Learned from the Unsealed Files:

- Financial institutions were complicit: Major banks processed billions in transactions despite filing their own red flags about Epstein

- Systemic failures were widespread: Banking oversight, law enforcement coordination, and regulatory systems all failed to stop Epstein’s enterprise

- Accountability remains incomplete: While settlements totaling hundreds of millions have been paid, no bank officials have faced criminal charges

- Document releases have been gradual: Information has emerged in stages through civil litigation, congressional oversight, and Freedom of Information requests

- Many questions remain: Full transparency has not been achieved, with significant files still sealed or unreleased

- Survivors continue seeking justice: Legal proceedings and advocacy efforts continue to push for accountability and systemic reform

🔮 What Comes Next?

As of November 2025, several ongoing processes may lead to additional disclosures:

- Congressional Investigations: Senate and House committees continue requesting documents from federal agencies

- Legislation: The Epstein Files Transparency Act and other bills aim to mandate further releases

- Court Orders: Additional unsealing motions may be filed in related civil litigation

- Treasury Records: Senator Wyden is seeking Senate approval for legislation to force release of Treasury Department files

This article focuses on factual information from court documents and official government releases. The ongoing nature of investigations and litigation means new information continues to emerge. Readers should seek primary sources and official court records for the most accurate information.

📚 Sources and Further Reading

Primary Sources:

- U.S. District Court Southern District of New York – Giuffre v. Maxwell case files

- U.S. Department of Justice – Official document releases and investigative memos

- U.S. House Committee on Oversight and Government Reform – Congressional releases

- Senate Finance Committee – Senator Wyden’s investigative reports

- Federal court orders and judicial opinions on unsealing motions